529 Plans/Custodian Accounts

Saving for your children is important, whether it’s for education or to set them up for success later in life, you have options to help start building their better future, today. Investment products can be used to save for the future; there are tax-advantaged plans designed to help with long-term savings for educational needs specifically. If you aren’t sure that higher education is something you want to save for, there are also custodian accounts, which will be available to the child after a certain age has been reached. Whichever your needs First Responders Group will help you explore options for the best way to save for your children’s future.

529 Plans

A 529 Plan is a tax-advantage investment plan designed to encourage saving for future education costs. The key features are:

- Tax benefits: contributions grow tax-deferred, and withdrawals used for qualified education expenses (such as tuition, books, and room and board) are tax free at the federal level, and tax treatment at the state level may vary.

- Flexibility: Funds can be used for a wide range of educational expenses including K-12 tuition (up to $18,000 annually for individuals or $34,000 for a married couple) college, and even some apprenticeship programs

- Control: the account owner maintains control of the funds and can change beneficiaries within the family if the original beneficiary doesn’t need the funds

- No Income limits: Unlike other savings accounts 529 plans have NO income limits making them accessible to all families.

*Prior to investing in a 529 Plan, investors should consider whether the investor's or designated beneficiary's home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state's qualified tuition program.

Custodian accounts/UGMA Account (Uniform Gifts to Minors Act):

- Purpose: Allows adults to transfer financial assets to a minor without the need for a formal trust.

- Assets Allowed: Limited to financial assets such as cash, stocks, bonds, and mutual funds.

- Ownership: The assets are technically owned by the minor, but controlled by a custodian until the child reaches the age of majority (18 or 21 depending on the state).

- Taxation: Any income generated by the assets in the account is taxed at the child’s tax rate, which is often lower than the adult’s rate.

- Use of Funds: The funds must be used for the benefit of the child, but there are no specific limitations on what the funds can be used for.

- Irrevocable: Once assets are placed in the UGMA account, they belong to the child and cannot be taken back

*This information is not intended as authoritative guidance or tax advice. You should consult with your tax advisor for guidance on your specific situation.

Take the Next Step

To learn more about 529 Plans and custodian accounts, schedule a complimentary no obligation meeting with the LPL Financial Advisor today.

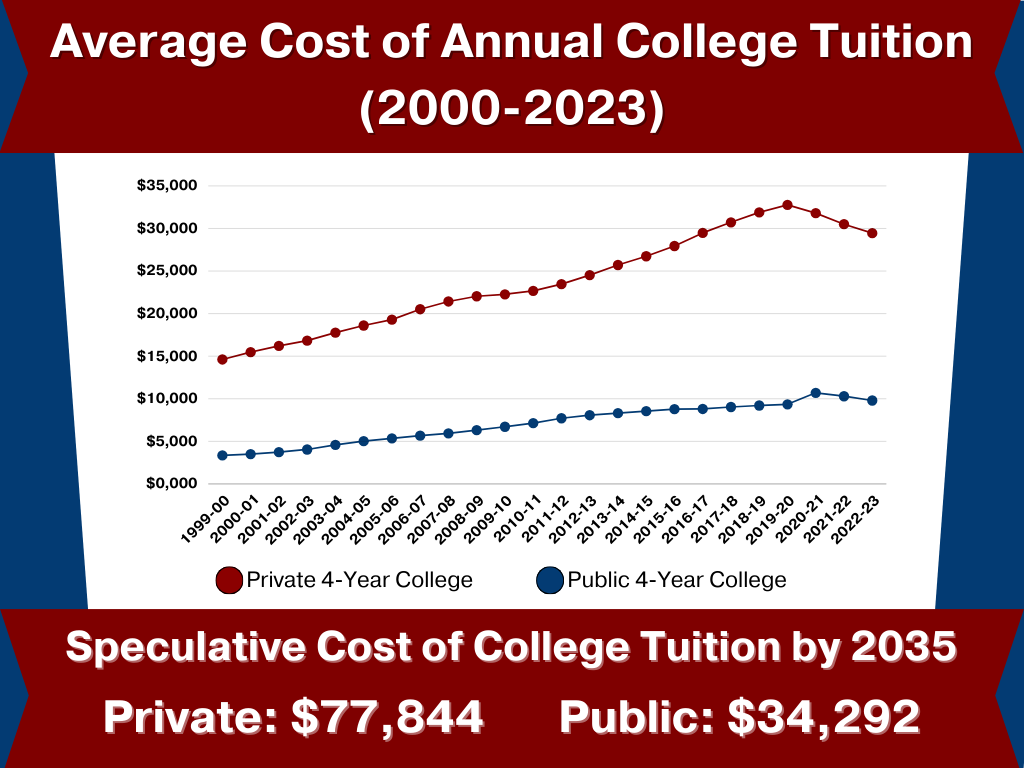

How Much Can You Save For Your Child's Education?

Compound Interest Calculator

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment, tax, or legal advice. We cannot and do not guarantee their applicability or accuracy in regard to your invidual circumstances. All examples are hypothertical and are for illustrative purposes. We encourage you to seek personalized advice from qualified a professional regarding all personal issues.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Boston Firefighters Credit Union (BFCU) and Frist Responders Group (FRG) are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using FRG, and may also be employees of BFCU. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, BFCU or FRG Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value |

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Boston Firefighters Credit Union (BFCU) provides referrals to financial Professionals of LPL Financial LLC (LPL) pursuant to an agreement that allows LPL to pay BFCU for these referrals. This creates an incentive for BFCU to make these referrals resulting in a conflict of interest. BFCU is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.